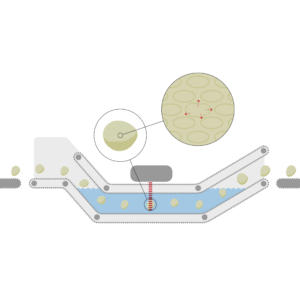

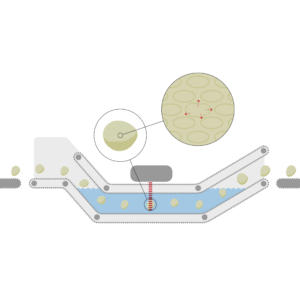

PEF (Pulsed Electric Field) technology in potato processing (Video)

The OPTICEPT PEF system for potato processing brings several advantages to the potato industry. Watch this video to learn more.

Unique technologies with extraordinary impact on the food and plant industries.

OptiCept’s technology is based on two platforms – CEPT (pulsed electric field) for food products and Vacuum infusion (VI) for plant products. In FoodTech, we create streamlined extraction processes, increased extraction from the raw material, extended shelf-life, reduced waste, and improved quality (taste, aroma, color, nutritional content) of the final product. In PlantTech, we extend the life span and improve the quality of cut flowers and improve the rooting of cuttings as well as quality. We reduce waste, pollution, and emissions. The technologies’ positive effects provide both financial benefits for the customer, better products for the consumer, and less impact on our environment.

Vacuum Infusion technology for treatment of cut flowers and cuttings

Our unique methods and technology are carefully designed and tailored for specific commodities like cut flowers and cuttings and food products like fruits, vegetables, plant-based milk, and food oils.

By integrating the PEF treatment in a olive oil production line we can achieve better efficiency, maximum performance, and superior olive oil quality.

Increased consumer vase-life and improved quality of cut flowers. Discover the benefits for growers, wholesalers and retailers of cut flowers.

Increase yield extraction and boost quality of juices.

Increased the survival rate of unrooted plant or forest cuttings.

Double shelf life of freshly squeezed quality juices.

Reduced drying time and enhanced quality of the final dried product

Create a wine more loaded of color and antocyanins and richer of phenolic compounds.

The OPTICEPT PEF system for potato processing brings several advantages to the potato industry. Watch this video to learn more.

The OptiCept team is contionouosly developing the OptiBoost technology for cuttings to include more and more tree species. After first trials with Corymbia – we are thrilled to share some quite amazing results for these species as well

Ready to elevate your knowledge and embrace the future of forestry propagation? Download your copy of our white paper on Vacuum Impregnation Technology.

Join us at Anuga FoodTec 2024! OptiCept Technologies is thrilled to be a part of the event, showcasing our innovative PEF technology in Foodtech.

In a world where consumers are increasingly concerned about the quality and freshness of their food, innovative technologies are emerging as key players in meeting these demands. Pulsed Electric Field (PEF) technology is one such innovation.

OptiCept Technologies, together with Canadian partner FPS Food Process Solutions Corp, has successfully completed the verification of its PEF technology for potato processing

Innovation and development are the foundation of OptiCept as a company. New products and applications are constantly being explored. OptiCepts Research & Development is based in Lund and develops existing products and looks at new exciting areas. The company’s technologies have proven to be applicable in a wide variety of fields.

Significant improvement is achieved using CEPT® technology in food oils. With the oliveCEPT® system - results of great importance have been reached for numerous olive oil producers. Including increased yield, improved production efficiency, and enhanced quality.

The juiceCEPT® deploys technology for juice production that improves the yield, quality, and shelf-life of the extracted juice. The treatment is continuous and easy to retrofit into existing juice extraction lines.

Within the dairy industry, considerable improvements can be made in processing whey, cheese and milk, but also liquid eggs. Enabling a more efficient production.

Create a wine richer with valuable biocomponents such as aromas, colorants and taste and reduce the maceration time in vinification. Continuous flow process that can treat up flow from small scale production up to major industrial applications.

With the CEPT® technology applied to your production of plant milk, a more streamlined process will be achieved. Decrease cost of production, increase shelf-life, and improve quality.

There are huge advantages of using CEPT compared with thermal processing when it comes to beer production. Increase both flavor and sensory factors and shelf-life.

The unique Vacuum Infusion method used in our OptiBoost systems brings numerous benefits for the flower industry. Prolonged consumer vase-life, fresher green leaves and better opening of the flowers. We are exploring how the technology could be used to change means of transportation, from air to sea freight.

The OptiBoost VI system have shown very positive impact on unrooted cuttings. Increased survival rate and better quality are just some of the improvements shown.

The use of CEPT® technology offers a wide range of benefits for the food industry – both from an economical and sustainable viewpoint. Learn more about what impact it could have on your business.

OptiCept is a company that sprung out of more than 20 years of research in food and plant technology. Based in the university and innovation city of Lund, Sweden, science is in our backbone.

OptiCept Technologies is a publicly listed company at Nasdaq First North.

Fill out the form below and we will get back to you as soon as possible.

OptiCept delivers innovative solutions for Food & Plant Industries to improve quality, performance & reduce waste.

Get the latest news from OptiCept Technologies straight to your inbox